In the mail and logistics services segment, we have successfully reinterpreted our original mission in a modern light, investing to keep our infrastructure abreast of the times, to meet the changing needs of our customers, and to develop innovative solutions. In particular, we are rolling out a new Joint Delivery Model designed to evolve our delivery services in line with developments in e-commerce. Furthermore in order to ensure an adequate level of protection of goods, we integrated the existing security model with the international standard TAPA-FSR (Transported Asset Protection Association – Facility Security Requirements) specifically dedicated to the logistics sector.

The postal services market is going through a period of radical change, primarily linked to the digital transformation, which has influenced the volume of letters and parcels in circulation. At the macro-trend level, the continuing structural decline in traditional mail volumes, replaced by digital forms of communication (e-mail, instant messaging, etc.), is accompanied by an increase in the volume of parcels sent.

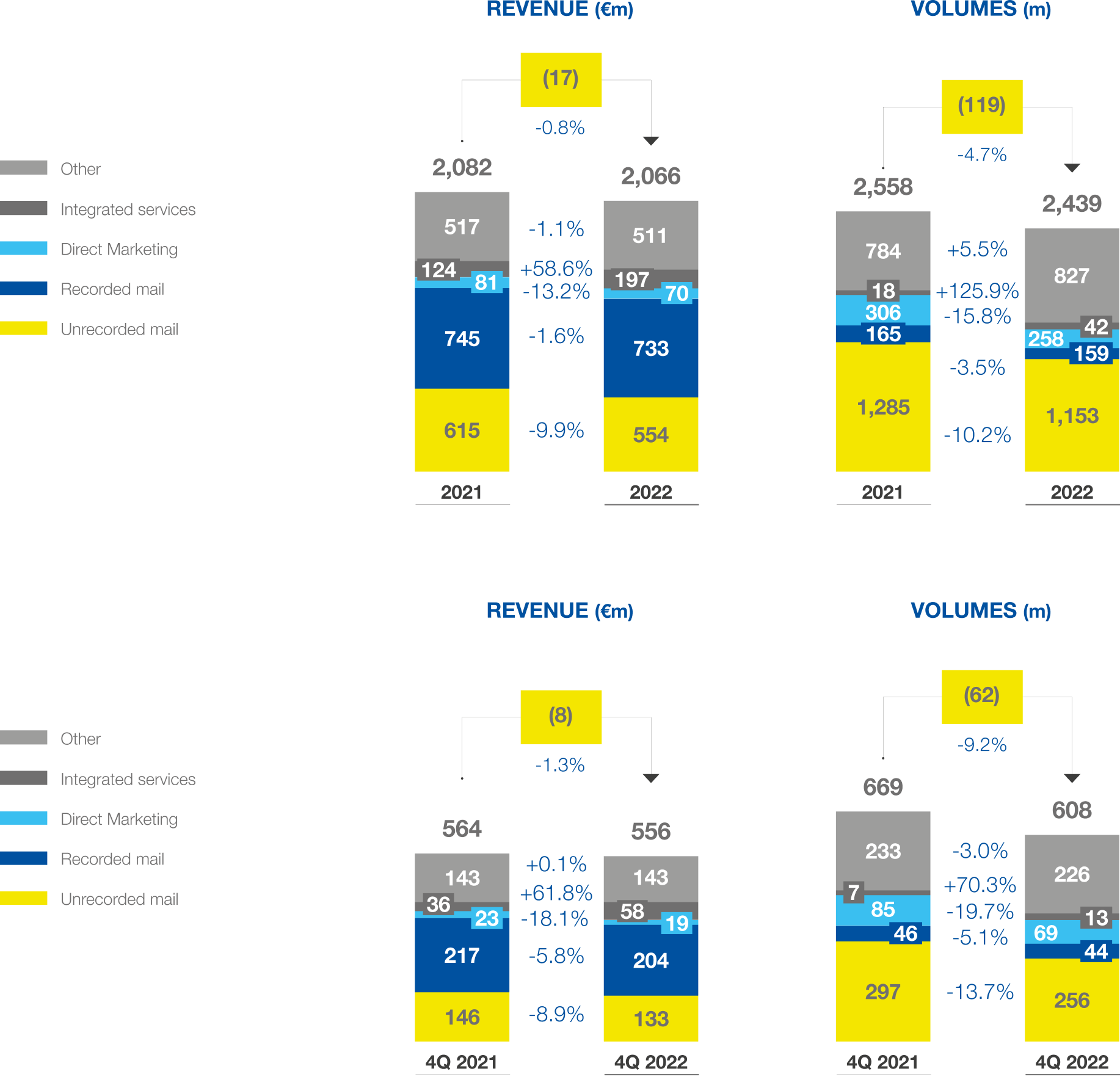

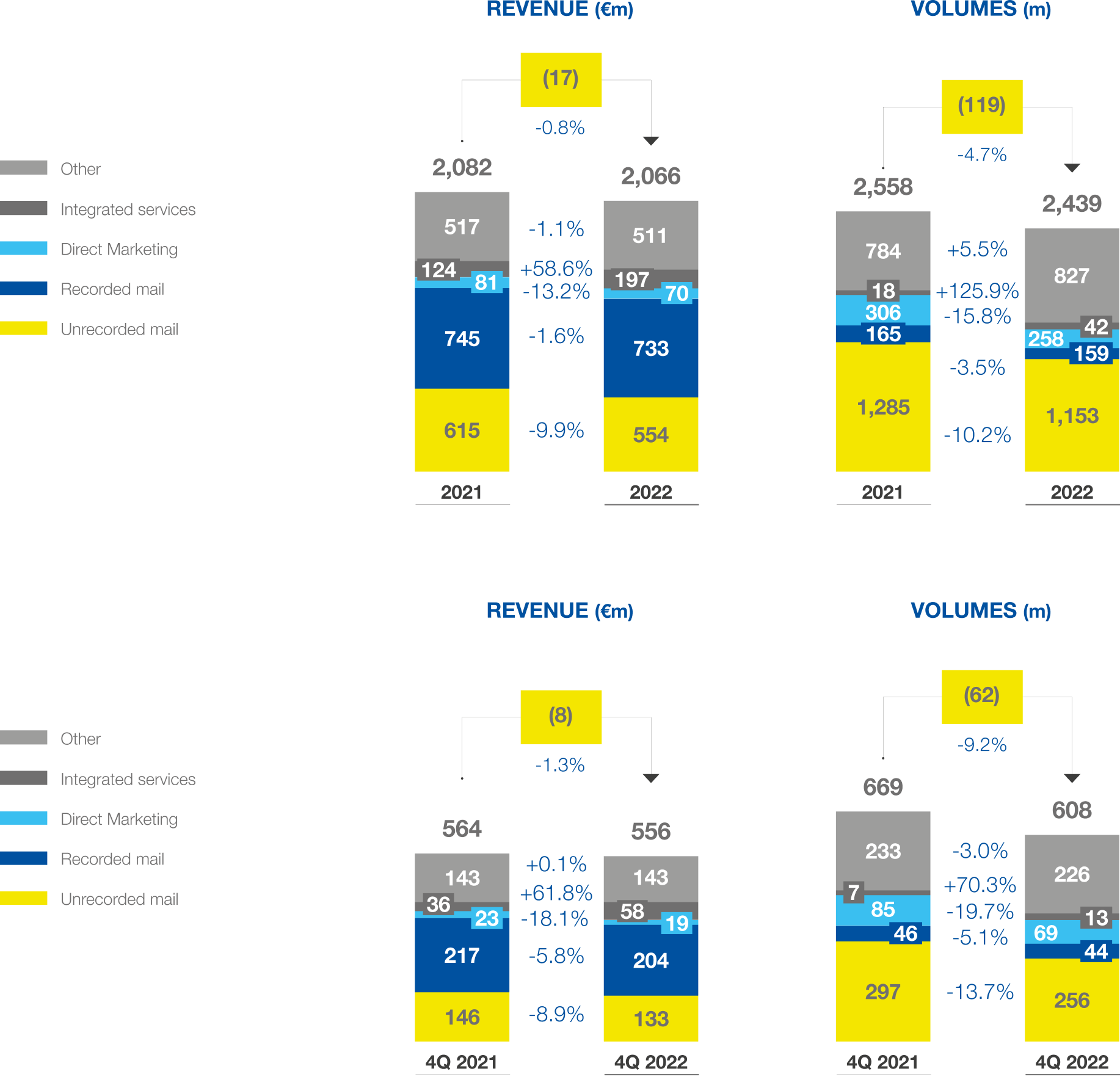

In particular, for the letter mail market, after the substantial drop in 2020 volumes (-19% compared to 2019), 2021 confirmed a trend of substantial stability (+0.2% compared to 2020)1. In 2022, the market decreased further (-5.3% compared to 2021)1, mainly as a consequence of e-substitution effects.

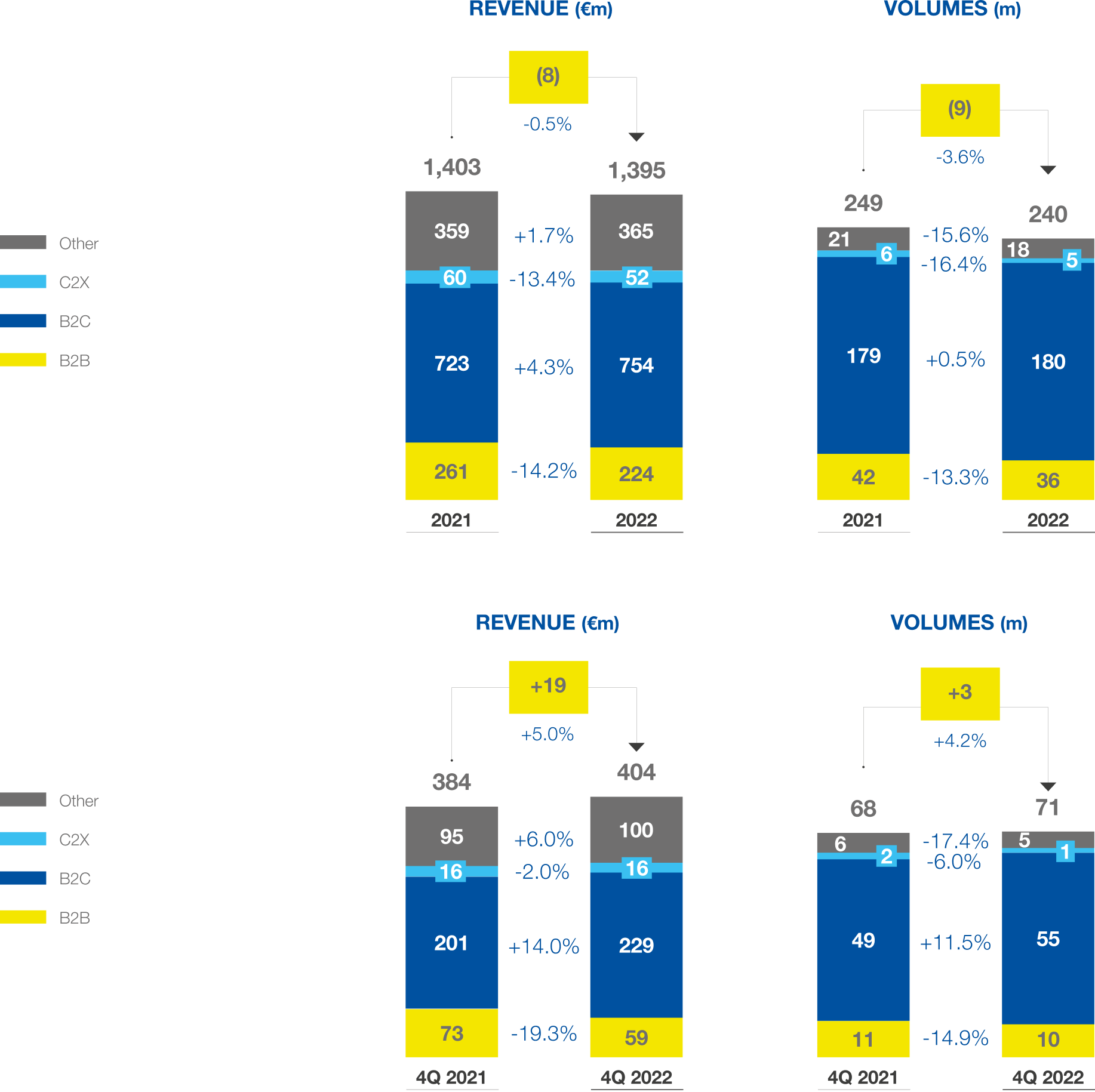

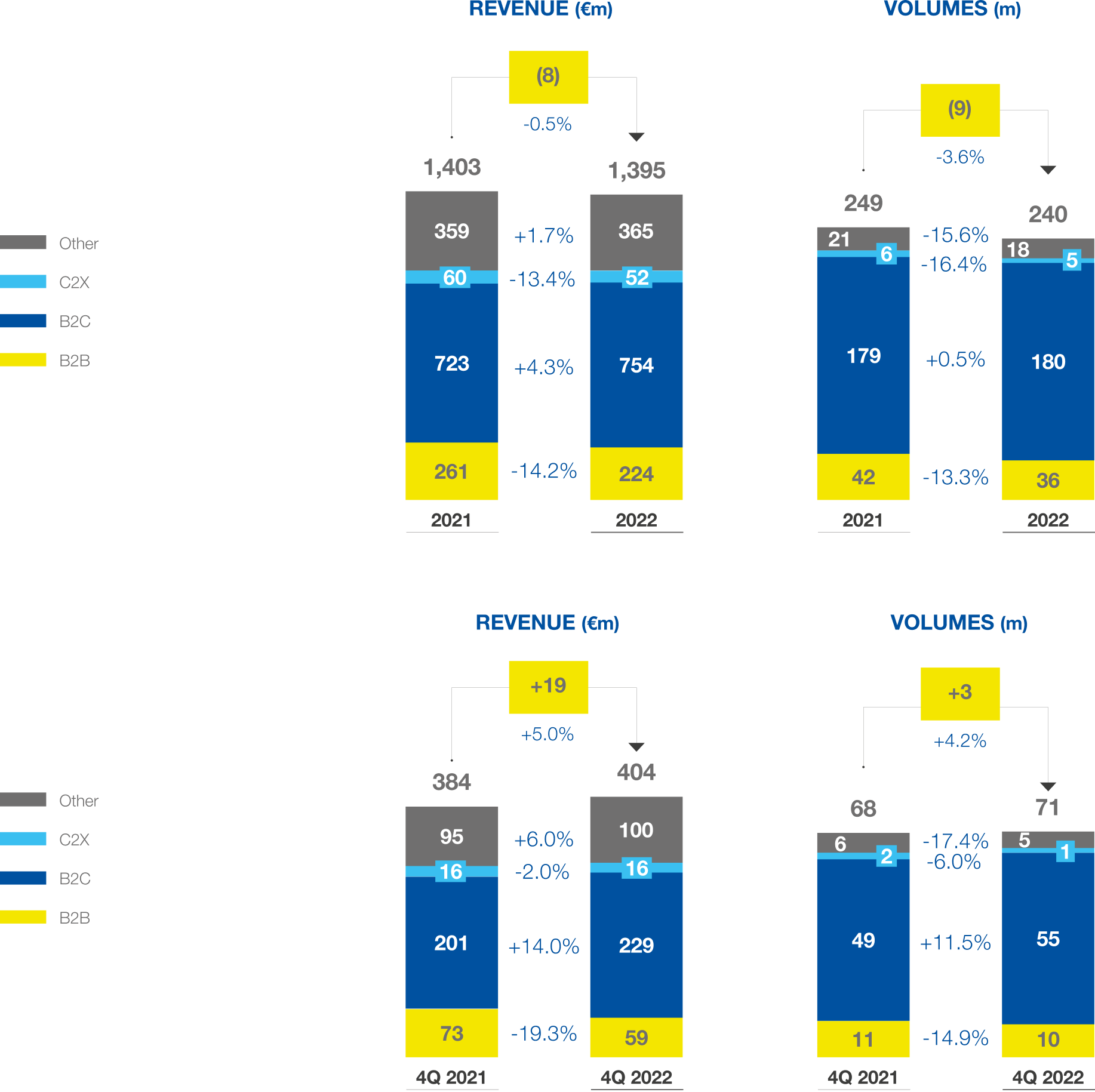

The parcel sector experienced a period of uncertainty in 2022, but this did not affect the value of the market, which grew strongly in the pandemic years. The effects conditioning the continuation of the growth trend recorded in recent years can be summarised as the generalised increase in costs brought about by the Russian-Ukrainian conflict, the rise in inflation with the consequent decrease in consumer purchasing power, and the lower propensity for private purchases (including on-line). This trend is also visible on a global level, as witnessed by the results of several leading companies.

For the Italian parcel sector, estimates for 20222 therefore point to a stable market value compared to 2021.

The Group’s performance in 2022 is solid and up on 2021 with a record EBIT value (€2,291 million, +24.1% y/y) in the Group’s history. These results confirm the effectiveness of the strategic guidelines defined by management and their execution, as well as the resilience demonstrated by the Group, which benefits from a diversified business structure and has continued to operate and grow in an uncertain economic scenario.

MAIL

The postal services market is going through a period of radical change, primarily linked to the digital transformation, which has influenced the volume of letters and parcels in circulation. At the macro-trend level, the continuing structural decline in traditional mail volumes, replaced by digital forms of communication (e-mail, instant messaging, etc.), is accompanied by an increase in the volume of parcels sent.

In particular, for the letter mail market, after the substantial drop in 2020 volumes (-19% compared to 2019), 2021 confirmed a trend of substantial stability (+0.2% compared to 2020)1. In 2022, the market decreased further (-5.3% compared to 2021)1, mainly as a consequence of e-substitution effects.

The parcel sector experienced a period of uncertainty in 2022, but this did not affect the value of the market, which grew strongly in the pandemic years. The effects conditioning the continuation of the growth trend recorded in recent years can be summarised as the generalised increase in costs brought about by the Russian-Ukrainian conflict, the rise in inflation with the consequent decrease in consumer purchasing power, and the lower propensity for private purchases (including on-line). This trend is also visible on a global level, as witnessed by the results of several leading companies.

For the Italian parcel sector, estimates for 20222 therefore point to a stable market value compared to 2021.

1 Internal calculations based on Agcom data (quarterly observatories and annual report 2022) and the latest available financial statements of companies operating in the postal

sector.

2. Source: Internal calculations on Cerved Databank data.

- Mail Service. We have been delivering letters to Italian households and enterprises since 1862. Today we are the number-one mail service provider in Italy, awarded exclusively with task of providing Universal Postal Service throughout the country. That task, which includes the delivery of mail and parcels to residents all throughout Italy, was renewed by the authorities for 15 years as of April 2011.

Project “Smart Letter Boxes”25. During 2022, 13 new mailboxes with screen were installed in Naples, which augment the 405 mailboxes installed.

This project involves replacing 10,500 traditional mailboxes with Smart boxes equipped with sensors to detect the presence of mail, environmental sensors to detect temperature, humidity and pollution and, for some, e-ink (electronic ink) screens to transmit advertising messages for the Group’s products and services.

- Hi-tech Solutions. To keep up with changes in the market driven by digitisation, we have long invested in our hybrid mail service, which enables digital documents to be “materialized” and delivered in print form to addressees. We are also on the cutting edge of electronic communications and cuber-security, offering solutions designed to guarantee the integrity of digital communications and transactions and their certification.

- Parcel Service. The spread of e-commerce has driven major growth in the parcel delivery market. This can be seen above all in our Express Courier, Logistics and Parcels business, which has been expanding constantly in terms of volumes and revenues and has now become strategic to our growth. The parcel offer has been enriched with a new feature that will allow sellers, users of Second Hand platforms24, to send parcels from proximity points (post offices, shops and tobacconists of the Punto Poste network), also in paperless mode, i.e. without the need to print the label. The extension of the Home delivery of medicines service continued in large cities and medium-small Municipalities, which are offered in instant mode (within 90 minutes of purchase), scheduled (at the desired time) or next day (day after purchase). The service is active in more than 170 Municipalities.

- Physical security. Poste Italiane joined the TAPA EMEA International Association, in order to strengthen physical security in the main logistic hubs and to provide greater protection to its customers and suppliers. Poste Italiane is committed to developing a culture of safety across the company to be achieved by offering training to its staff, through specific policies and procedures, through the adoption of advanced technological solutions and the implementation of processes and technologies, through the improvement of the company's organizational structure and the enhancement of the professional skills of those working in security. All these elements are aimed at creating a security system, the function of which is constantly monitored by process indicators and 24/7 control rooms, to ensure prompt intervention when emergencies happen.

The Group’s performance in 2022 is solid and up on 2021 with a record EBIT value (€2,291 million, +24.1% y/y) in the Group’s history. These results confirm the effectiveness of the strategic guidelines defined by management and their execution, as well as the resilience demonstrated by the Group, which benefits from a diversified business structure and has continued to operate and grow in an uncertain economic scenario.

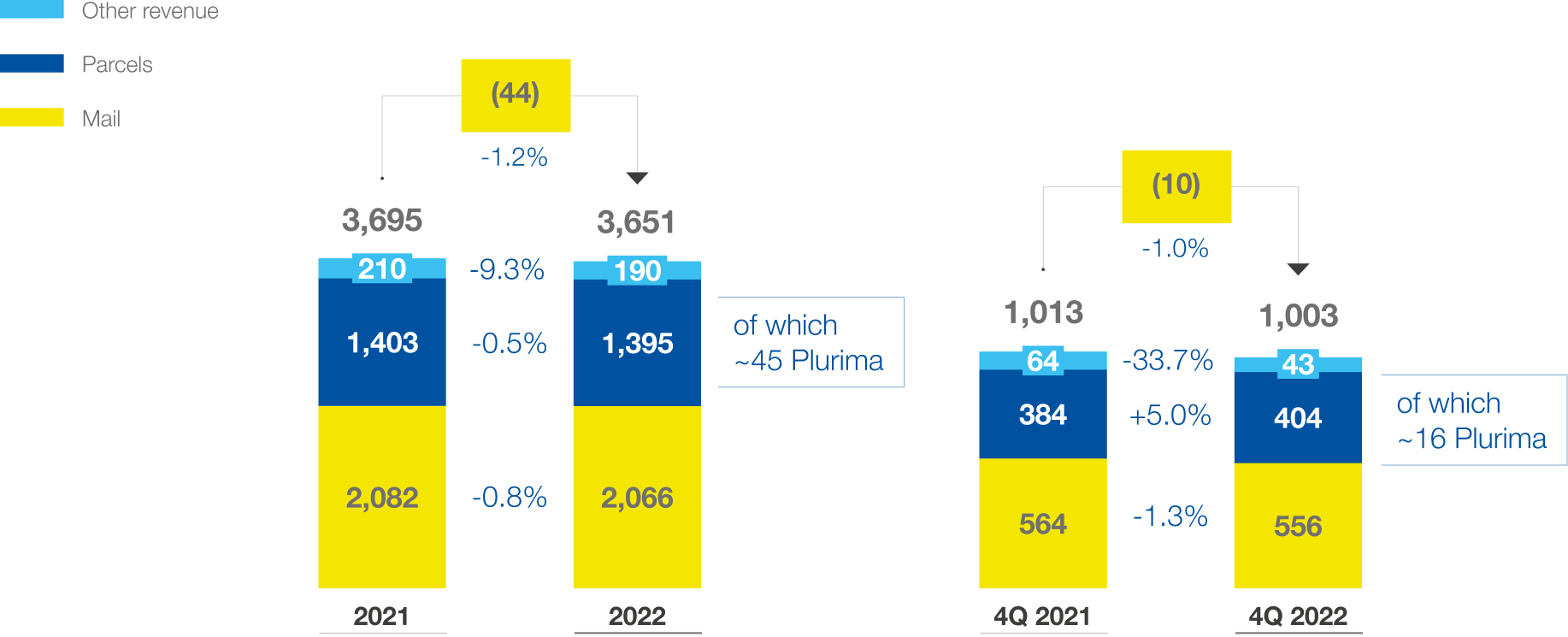

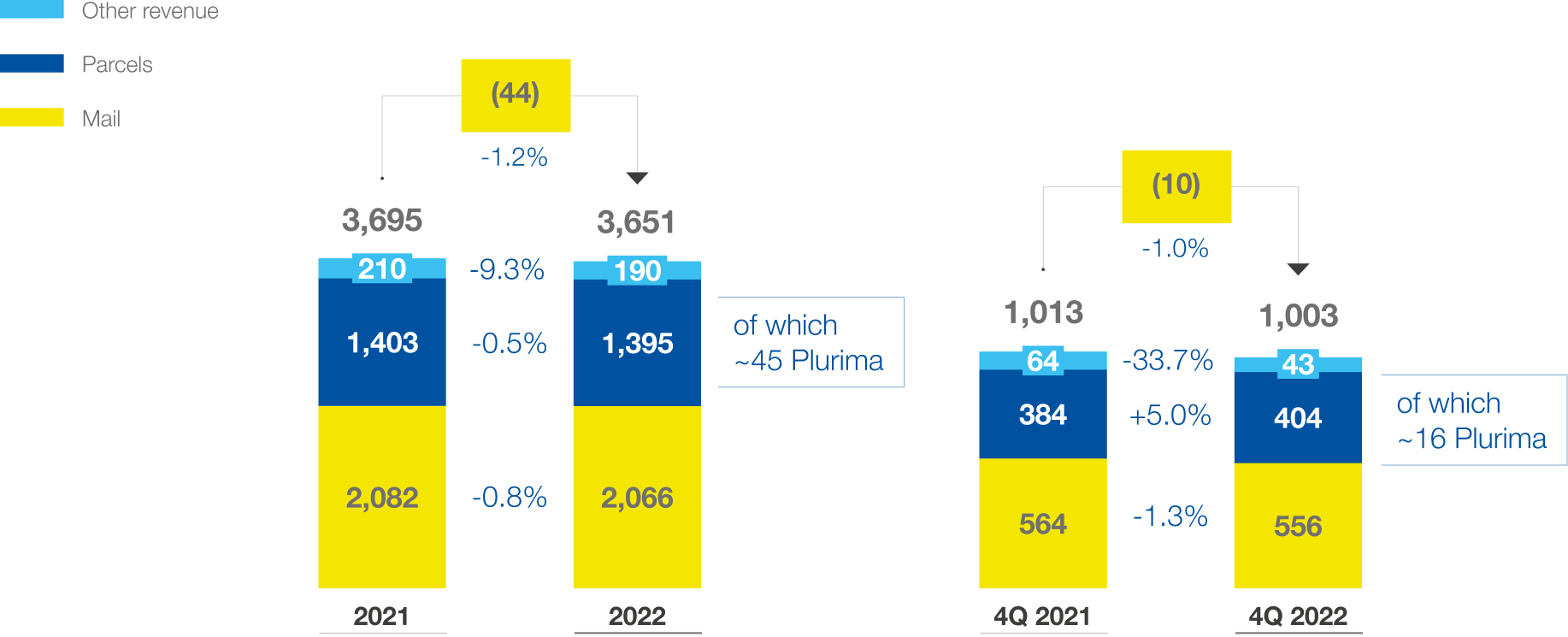

| FY 2022 External Revenues (€m) | 3,651 |

|---|---|

| Other revenue | 190 |

| Parcel | 1,395 |

| 2,066 |

EXTERNAL REVENUE

(€m)

PARCELS

Data source: Annual Report 2022