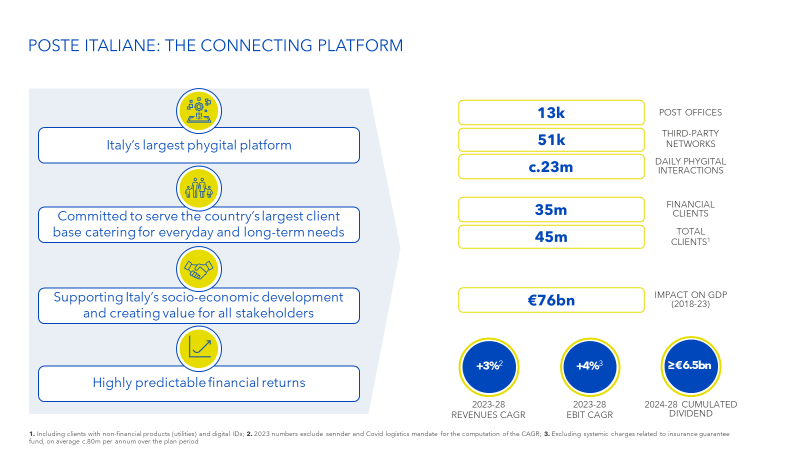

An anti-fragile, platform company and the largest phygital platform in Italy, thriving on the integration of multiple touchpoints and creating an omnichannel ecosystem where each portion of the platform complements the others. Financial stability, an increasingly sustainable business model and a generous dividend policy are fundamental values.

12,755 Post Offices in every corner of the country, often where no other trusted institution can be found.

51,000 third-party network touchpoints lead to 23 million daily interactions with our 45 million clients.

Poste Italiane's business extends far beyond traditional postal services. With diversified revenue streams in financial services, insurance, logistics, payments, mobile and broadband connections as well as a retail gas and electricity offer, we have built a robust product that mitigates risks associated with fluctuations in any single sector. This diversification ensures steady revenue generation and shields the company from economic downturns.

Trends

Poste Italiane

In view of the complexity of Poste Italiane and the numerous business sectors in which the Group operates, as well as the legal and reputational impacts, the Company has defined an integrated compliance process at Group level, with the specific aim of monitoring - in a structured way for each level of the company and in a manner appropriate to each business sector - the risks of non-compliance to which the Group is exposed, fully implementing the principles of integrity, transparency and legality.

Find out more

In particular, globalisation and the interconnectedness of peoples, climate change, accelerated urbanisation and overcrowding in urban areas, as well as large migration flows, favour the rapid spread and proliferation of infectious diseases.

In addition, antimicrobial resistance is increasing due to the overuse and misuse of antibiotics.

Finally, global food trade can contribute to the spread of disease through the transport of contaminated food.

Poste Italiane

The experience gained in the management of the health emergency resulting from the spread of Covid-19, has allowed the Group to develop operating methods that have significantly reduced the potential impact on business continuity.

Find out more

In particular, the development of technology is a process that generates impacts that move in a dual direction: positive, for innovations that allow us to pursue more efficient, sustainable and flexible solutions; negative, due to the consequences that robotics and data centres can have in terms of potential cyber threats, polluting emissions and energy consumption.

In addition, due to the widespread adoption of agile working, the boundary between work and private life becomes more blurred and there is greater isolation of people, while at the same time requiring companies to implement upskilled and reskilled programmes with regard to digital skills for workers.

In view of the activities carried out by Poste Italiane, it is necessary to consider that the e-substitution is drawing a new market perimeter, produced by the exceedance of the digital market (electronic communications) and the Parcels segment (especially due to the spread of e-commerce), as well as changes in the habits and behavioural patterns of the population.

Poste Italiane

For Poste Italiane, innovation and digitalisation are two central drivers of strategic progress and enable it to guarantee its customers innovative technological solutions, also through the integration of its own products and services with those of third parties.

Poste Italiane has embarked on a digitalisation process that has influenced both its offer and business processes through the evolution of its omnichannel distribution model, which allows the Company to deliver services in an agile manner and in step with needs of customers.

Find out more

Attacks on IT systems can compromise IT infrastructure, allowing company and customer data to be stolen or used, or malware to be planted, in order to access company funds and/ or damage the reputation and brand.

The increasing demand for personal identification and authentication, including through the use of biometric identifiers, may increase the risk of fraud and identity theft.

In relation to cyber security, there is a proliferation of regulations aimed at ensuring the security of products with digital components, governing the design and development phases of the products themselves, as well as their entire life cycle. This implies the creation of a comprehensive cyber security regulatory framework that facilitates compliance for hardware and software manufacturers.

The ultimate goal is to improve transparency regarding the security features of digital products in order to enable both companies and consumers to use them safely.

It is also essential to consider technological advances in the field of Artificial Intelligence, which could potentially lead to new forms of cyber attacks capable of overcoming the preventive and defensive measures implemented by Poste Italiane.

Poste Italiane

Managing cyber security risk is a key priority for the Group, considering the increasing number of cyber threats and the sensitivity of the data managed. Poste Italiane is committed to protecting company data with the aim of safeguarding its customers and all its stakeholders through technologically advanced protection systems and in accordance with the measures set out in the relevant regulations.

Find out more

Such events have catastrophic effects on local communities, causing enormous damage to infrastructure and natural resources with long-term economic consequences; financial losses are often significant, especially in the agricultural, tourism, and insurance sectors.

Climate change can destabilise societies and accentuate socio-economic inequalities, contributing to political tensions and internal and external conflicts.

Moreover, the need to mitigate and adapt to climate change requires political and diplomatic action at national and international level, not helped by the geopolitical instability of recent years.

The combat against climate change, therefore, is not an option but a must. It is therefore necessary to consider these aspects when defining the strategies and operational activities of companies.

Poste Italiane

Poste Italiane analyses, among others, the risks related to climate change also in relation to the long term. Specifically, the risk management model adopted by the Group considers both the possible impacts that climate change-related phenomena may have on the business of Poste Italiane (indirect impact) and those that Company’s activities may have on climate (direct impact). The process of identifying and assessing risks and environmental management methods also extends to counterparties, impacting the procurement processes and any extraordinary finance transactions, providing, among other things, for the identification of suppliers and partners that may present risks related to environmental protection, also through a multi-dimensional analysis that takes into account parameters such as: possession of environmental, quality and energy performance certifications and adoption of environmental management systems, ethical standards of conduct and Minimum Environmental Criteria (MEC).

Find out more

The payments industry is undergoing major changes related to the advent of new technologies and the development of Artificial Intelligence, as well as the proliferation of relevant legislation and regulations (e.g. the European Payment Services Directive - PSD2). Companies must be ready to adapt and innovate in order to capitalise on new opportunities and mitigate the associated risks.

Poste Italiane

In order to provide new payment solutions and respond to the changing needs of its customers, Poste Italiane is developing new digital payment services, intercepting and driving customer habits in the context of digital transformation, through the creation of innovative products and services that simplify everyday life.

Find out more

Over the years, the revolution in mobility and automation of machines and processes will lead to a radically different world, characterised by greater efficiency, sustainability and connectivity. However, it will be essential to address the social, economic and regulatory challenges that accompany this transformation to ensure that its benefits are fairly distributed and its potential risks mitigated.

In addition, the shift towards more sustainable modes of transport, the control of polluting emissions, the environmental Sustainability of major works are issues that increasingly guide the preferences of citizens and the choices of transport operators.

Poste Italiane

Poste Italiane, aware that the vehicles used to carry out its logistics and delivery activities do not lend themselves to any type of optimisation, has been replacing them with equivalent electric-powered vehicles in recent years, improving its fleet in order to reduce atmospheric pollution. Among companies in the utility sector, Poste Italiane has one of the largest fleets of 100%.

Find out more

In particular, during periods of economic instability or uncertainty, consumers tend to be more cautious in their spending: they might avoid impulsive purchases or risky investments, preferring to buy cheaper products and services or concentrate their spending on essential goods and services, such as food, basic commodities and health services.

Moreover, rising low interest rates and volatile financial markets may influence the choices of investors, who may prefer investments that are considered safe or less volatile, such as certificates of deposit or government bonds.

With regard to the financial services offered by Poste Italiane, if consumers perceive a favourable economic situation and feel secure about the future, they may be more inclined to take financial risks. Conversely, if consumers are pessimistic about the economy and fear for their financial security, they might reduce investment activities or direct them towards lower-risk products.

Changes in consumer purchasing and investment choices in response to the macroeconomic scenario can have a significant impact on the economy and market dynamics in the long run, influencing consumption through changes in consumption patterns, changes in investment sectors and overall economic growth.

Poste Italiane

In addition to distinguishing itself through a diversified business structure that allows it to benefit from a constant physiological balancing effect between the trends affecting its businesses, the Poste Italiane Group has historically demonstrated resilience in times of economic uncertainty and financial turbulence, indeed establishing itself as a “safe haven” for savers, thanks to a portfolio of financial offerings characterised by products with low risk exposure and volatility.

Find out more

The current geopolitical context has had major impacts on the macro-economic context, putting pressure on global supply chains and commodity markets and fuelling inflationary dynamics on a global scale.

In the major advanced economies, the slowdown in economic activity is attributable to weakening demand and the start of a cycle of tightening monetary policies adopted by the major central banks to counter rising inflationary pressures.

In a dynamic and globalised world, local crises quickly become global crises, with huge economic, social and geopolitical repercussions and resulting in new priorities in terms of countries’ domestic policies.

We could see a de-globalisation of the economy with consequent reshoring of the supply chain.

Geopolitical instability exposes countries to new risks from attacks on strategic infrastructure or digital infrastructure (communication networks, data centres or key government systems). When such infrastructure is damaged, there are major repercussions in economic terms, as well as potential reputational impacts.

Poste Italiane

Poste Italiane continually monitors the political, social and macro-economic context and regulatory aspects that could impact on its business, so as to identify and prioritise the response measures to be undertaken based on the different macro-economic scenarios and geopolitical projections.

Find out more

Increased life expectancy is, however, accompanied by an increased incidence of chronic diseases that have replaced infectious ones.

However, in Italy, the presence of private healthcare provision is still limited compared to other countries, while the costs of the public healthcare system are increasing at a faster rate than overall spending.

There is a progressive movement towards a system in which citizens supplement public social security and health services with private insurance policies in order to guarantee themselves a level of care appropriate to their needs, with the ever-increasing risk of under-insurance of the weaker sections of the population who cannot afford such services.

Poste Italiane

In this context, the insurance activity carried out by the Poste Italiane Group through the Poste Vita insurance group can play a fundamental role, as the company, through the offer of flexible and modular protection solutions based on the identification of the lifelong needs of its customers, aims to expand its market share in a sector, that of health insurance, which is constantly growing and increasingly competitive. Furthermore, for the Poste Vita Insurance Group, it is essential to align itself with corporate objectives, and therefore define and market its products, pursuing the objectives of enhancing the social role of insurance protection and inclusiveness through facilitating economic accessibility.

Finally, the Poste Italiane Group considers the health and well-being of its employees to be a priority element of its human resources management strategy and, in light of the context described above, considers the risk of increased costs related to the growing need for care for its employees who cannot rely on the public health service.

Find out more

The average number of AI functionalities used by companies has doubled in the last three years. These capabilities mainly include natural language text generation, computer vision and operation optimisation technologies.

At the same time, investments in AI have increased significantly over time and are expected to grow exponentially in the future.

With reference to the impact of this trend on Poste Italiane’s areas of operation, the modernisation of postal services through AI is revolutionising sorting, delivery and tracking processes, making them more efficient, accurate and cost-effective.

In the financial sphere, AI offers new opportunities in transaction security management and financial data analysis, also facilitating the detection of suspicious patterns and abnormal behaviour, thus reducing the spread of fraud and misconduct.

Finally, the use of AI in customer service across the Group’s different business units (Insurance Services, Financial Services, Mail, Parcels and Distribution and Payments and Mobile) enables them to understand and, in many cases, anticipate consumer requests and needs, improving the relationship between consumer and company.

However, in this context, it is equally crucial to consider the negative consequences and ethical implications associated with AI and its rapid development. These include the risk of increased unemployment, risks to user privacy and reputational risks associated with misunderstandings caused by the use of digital assistants.

Poste Italiane

Innovation and digitalisation constitute, for Poste Italiane, two central drivers for strategic progress and allow it to guarantee its customers innovative solutions, also through the adoption of technologies based on artificial intelligence in its processes, products and services, while still knowing how to manage the risks associated with such disruptive technologies.

Find out more

Market context per Business Area

MAIL, PARCEL & DISTRIBUTION DIVISION

The postal services market is going through a phase of radical change, primarily linked to the digital and logistics transformation, which has influenced the volume of letters and parcels. The secular decline in traditional mail, replaced with digital forms of communication is accompanied by a significant increase in parcels volume.The parcel sector, after its exponential increase in the pandemic years, experienced a period of uncertainty in 2023 that did not, however, affect the value of the market. E-Commerce confirmed as the key driver of growth in the parcels segment, mainly for low-value items.

FINANCIAL SERVICES DIVISION

In 2023, the equity market began strong in January due to less aggressive central bank policies, but this momentum waned in February as central banks took a tougher stance on inflation. March saw increased tensions in the European banking sector, notably with the collapse of Silicon Valley Bank, the bankruptcy of Signature Bank, and Credit Suisse's crisis. Despite these issues, a strong response from monetary authorities and higher investor risk appetite led to solid stock market performance.The credit market experienced a tightening of spreads early in the year, which reversed in March due to the banking crisis, leading to widened spreads, especially in the banking sector. Over the summer, corporate markets in Europe and the US faced rising rates and wider spreads, particularly in the High Yield segment. However, from October onwards, the market saw a period of lowering rates, resulting in strong performances, with the Investment Grade index rising by 7.4% in Europe.

INSURANCE SERVICES DIVISION

In 2023, the market was influenced by ongoing uncertainties from the war in Ukraine, the Israeli-Palestinian conflict, and persistently high levels of inflation and interest rates, although these rates slowed compared to the beginning of the year.The life insurance segment experienced negative net inflows of -€22.8 billion, a significant drop of about €40 billion compared to the positive €16 billion in 2022. This decline was due to a 3.2% drop in premiums, mainly affecting Class III life products, and a 45% increase in outflows, largely from higher lapses in Class I life policies, driven by savers seeking higher returns amid rising rates. The lapse rate increased to 10.63% from 6.71% in 2022.

PAYMENTS & MOBILE DIVISION

The Italian digital payments market is historically less evolved than that of other European countries (in Italy the number of digital transactions per capita is well below the European average). With the pandemic crisis, new payment habits have been consolidated and this trend seems to be reversing.In September 2023, the Italian payment cards market saw domestic transactions surpass €322 billion, a 17.8% increase from September 2022, driven by inflation. Transactions grew by 23.2% to 7.2 billion, with notable growth in debit cards (+22%) and credit cards (+36%). The number of active cards rose slightly to 93.8 million. The mobile telephony market showed a slight increase in Human-to-Human SIMs, with MVNOs gaining market share. The energy market experienced a price rebalancing due to mild winter temperatures and diversified gas supplies, leading to lower gas and electricity prices by the end of 2023.

Poste’s strengths

Over-delivering targets

We have demonstrated our nature of being a truly antifragile company: we have always adapted to a rapidly evolving operating context, transforming challenges into opportunities.

Through strategic initiatives, operational efficiency and customer-centric innovations, Poste Italiane consistently delivers strong financial results, driving shareholder value and market outperformance.

In 2023 we posted a record EBIT of €2.62 billion, twice the 2017 number, with a similar trend for our compelling dividend distribution.

Poste Italiane has consistently exceeded market expectations, demonstrating its ability to outperform amid evolving market conditions. Through strategic initiatives, operational efficiency enhancements, and customer-centric innovations, the company consistently delivers strong financial results, driving shareholder value and market outperformance.

OVERDELIVERING UNDER DIFFERENT MARKET ENVIRONMENTS

CONSISTENTLY BEATING TARGETS WHILE DRIVING SUSTAINABLE RETURNS

| € BN UNLESS OTHERWISE STATED | 2017 | 2018 | 2019 | 20204 | 2021 | 20221 | 2023 |

|---|---|---|---|---|---|---|---|

| Revenues 2 |

|

|

10.96

|

10.53

|

11.22

|

|

|

| Ebit |

1.12

|

|

|

|

1.85

|

|

|

| Net profit 3 |

0.69

|

|

|

|

1.58

|

|

|

| DPS (€) |

0.42

|

0.44

|

0.46

|

|

|

|

|

| Achieved |

|

1 2022 numbers are restated for IFRS17

2 Revenues exclude commodity price and pass-through charges related to the energy business. 2017-’19 revenues are restated net of interest expenses and capital losses on investment portfolio;

3 0.76bn excluding write-off of 0.07bn for 2017; 1.01bn excluding positive tax one-offs of 0.39bn for 2018; 1.23bn excluding SIA stake revaluation and positive tax one-offs of

0.11bn for 2019; 1.11bn excluding positive tax one-offs of 0.1bn for 2020; 1.33bn excluding Nexi stake revaluation and positive tax one-offs of 0.25bn for 2021.

4 Impacted by Covid-19

5 Proposed

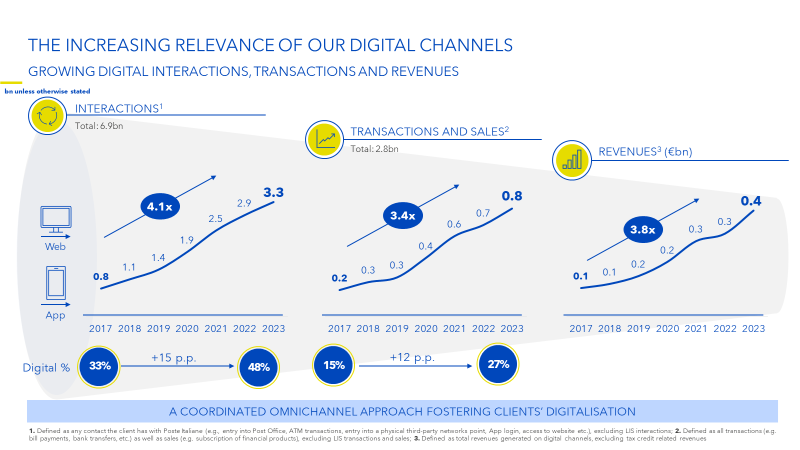

Hybrid clients drive value

Our digital clients grew by around 50% from 11.6 million in 2020 to 17.2 million in 2023; we have 12 million payment wallets and we are a SPID digital identity provider to over 27 million Italians.

Our Customer experience has grown exponentially since 2017, especially on our Apps, resulting in an increased use and loyalty of our clients (1 out of 4 clients uses our apps every day).

Digitalisation is also a key driver of value-creation for the group: in fact, hybrid clients using both physical and digital channels grew by 64% in the last three years, such clients have a higher cross-selling rate than average to the benefit of our bottom line.

Increasing relevance of our digital channels

Out of 2.8 billion annual transactions and sales almost 1 billion, or 27%, are completed through our digital channels.

Overall, nearly half a billion in revenues are generated through our digital channels, almost four times 2017 levels.

As an integrated platform-company we coordinate the work of our networks in order to maximise our omnichannel potential.

Our purpose remains to reach everyone in an inclusive way through their preferred channel, digital or physical, bridged by remote assistance.

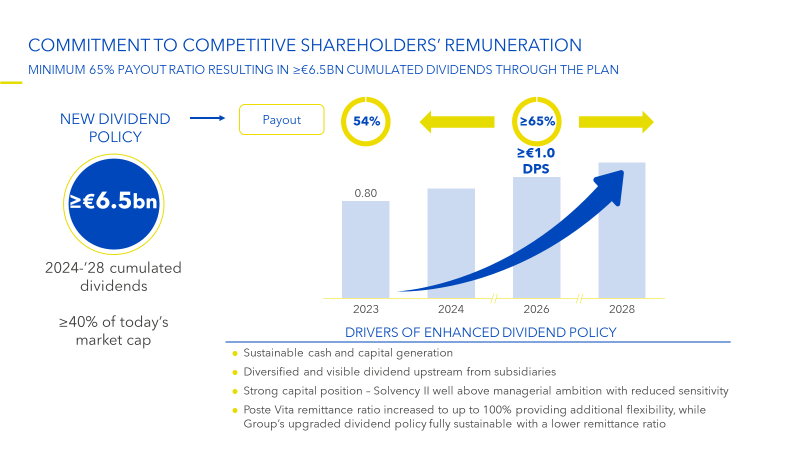

Dividend growth

At the same time, our group shareholders’ equity has constantly increased from €6.6 billion euro in 2016 to €11 billion in 2023.

Our dividend per share has grown at a remarkable 11% annualised rate since 2016, with targets upgraded every single year since 2021.

Looking at total shareholder return, our performance has been well above the one of the Italian stock market index.

Our dividend distribution has been enabled by a strong and sustainable financial performance supported by our diversified business model.

Sustainable profitability and strong cash flow generation supporting enhanced dividend policy

Organic revenues will continue to grow steadily, reaching €13.5 billion in 2028, with a positive contribution from all segments and increasing exposure to growing businesses.

As a result, we intend to grow our dividend per share at a 7% annualised rate on the basis of a payout ratio of at least 65% over the plan period.

KEY FINANCIAL TARGETS

Sustainable profitability and strong cash flow generation supporting enhanced dividend policy

| € bn (€bn unless otherwise stated) |

2023 | 2024 | 2026 | 2028 | CAGR 23 - 28 |

| REVENUE | 11.99 | 12.0 | 12.7 | 13.5 | +c.3%1 |

| EBIT2 | 2.62 | 2.7 | 2.9 | 3.2 | +c.4% |

| NET PROFIT | 1.93 | 1.9 | 2.0 | 2.3 | +c.4%3 |

|

DIVIDEND PER SHARE (€) |

0.80 |

|

≥1.0 | +c.7% | |

| DIVIDEND PAYOUT | 54% | ≥65% over the plan | |||

1 2023 numbers exclude sender and Covid related mandate for a total of 0.2bn for the computation of the CAGR;

2 Excluding systemic charges related to insurance guarantee fund, on average c.80m per annum over the plan period;

3 2023 numbers exclude sennder and one-off bonus for the computation of the CAGR

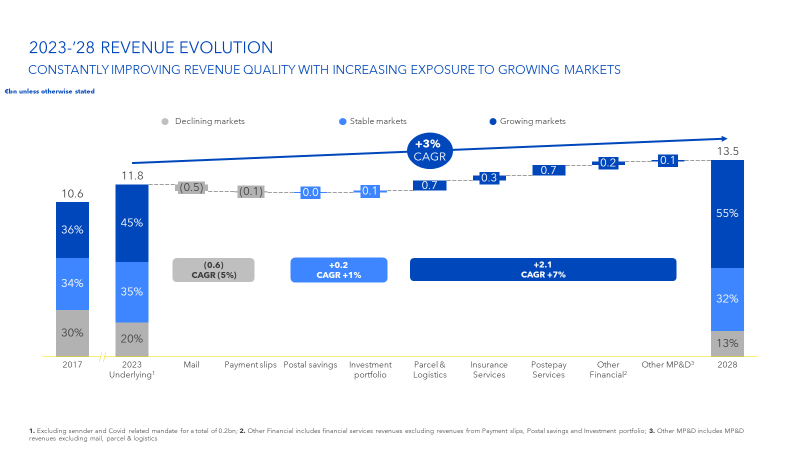

Constantly improving revenue quality with increasing exposure to growing markets

The transformational journey is not just one of quantity, but also quality. We have identified businesses with structurally growing trends, which allowed us to more than compensate declining trends in others.

Revenues will grow to reach €13.5 billion in 2028, with a positive contribution from all business segments.

The revenue composition that we are targeting envisages a changed mix, with a well-diversified business increasingly exposed to growing markets and new businesses.

In particular, the share of revenues related to growing markets will increase to 55% by 2028, whilst we will be reducing our exposure to declining markets.

By 2028 we expect over €2 billion additional revenues from higher growth businesses.

Excellent returns for shareholders

Delivering the targets will result in a distribution of over €6.5 billion cumulated dividends between 2024 and 2028, representing over 40% of current market cap.

The switch to a payout ratio will result in higher distribution when overdelivering on targets.

Our compelling dividend policy is backed by a strong visibility on future cash flow and capital generation, thanks to increased and diversified dividend upstreaming from all subsidiaries.

Successful ESG Strategy benefitting all stakeholders and the country as a whole

Sustainability is an integral component of Poste Italiane’s business activities, processes, and strategy, where financial and ESG objectives are intertwined. Through the effective implementation of our ESG strategy based on eight pillars, we continue to create responsible growth.

Poste Italiane’s unique platform plays a pivotal role in supporting Italy’s social cohesion and digitalisation, thanks to the decisive contribution of our people as the key engine of innovation. For the 2024-2028 period, we have added 53 new targets, with an enhanced focus on accessibility and inclusivity for our clients and employees.

Our enduring commitment to advancing our sustainability journey has earned us inclusion in the most prestigious global indices and ratings, strengthening our market reputation.

ESG STRATEGIC PLAN GROUNDED ON 8 PILLARS53 new ESG targets integrated into group strategy ensuring shared value creation and alignment with SDGs

Integrity and transparency

Integrity and transparency

Internal Control over Sustainability Reporting CSRD aligned 2 staff training initiatives on ethical principles by 2024.

+ Learn more

People development

People development

Campus Italia: 5 interconnected employee learning hubs 40 professional orientation initiatives for youth by 2025.

+ Learn more

Diversity and inclusion

Diversity and inclusion

1 age management program by 2025 Enhance accessibility and inclusivity measures (e.g. "Dyslexia Friendly company" certification and digital inclusion).

+ Learn more

Creating value for the country

Creating value for the country

Polis Project full completion by 2026 Strengthen corporate employee volunteering projects.

+ Learn more

Green Transition

Green Transition

(42%)1 Scope 1, 2 tCO2e emissions reduction and Group’s carbon neutrality by 2030 >98% of population within 5 mins of a PUDO2 by 2028.

+ Learn more

Customer experience

Customer experience

+10p.p. customer experience rate in 2028 (vs 2023) 4 Hub & Spoke model initiatives to support national entrepreneurship, also focusing on D&I by 2028.

Learn more

Innovation

Innovation

Ethical Framework for Artificial Intelligence by 2026 +115% digital transactions financial services, insurance, and payments by 2024 (vs 2023).

+ Learn more

Sustainable finance

Sustainable finance

Portfolio decarbonisation (Net Zero by 2050) 100% of Poste Vita products SFDR art.8 compliant by 2024.

+ Learn more