Main strategic highlights

Our 2024-2028 strategic plan reshapes our business to best seize growth opportunities. There are two points at the centre of our strategy: a new commercial service model that maximises the value of our platform, and a transformation of our logistics to create a technological network increasingly oriented towards parcel management. In this way, we intend to ensure the financial sustainability of the mail and parcel business.

"Poste Italiane’s transformation journey started back in 2017 with a simple ambition: to maximise value for our clients and be the most effective and trusted distribution network in Italy. We have gone beyond that and established ourselves as the largest phygital platform in Italy, thriving on the integration of multiple touchpoints and creating an omnichannel ecosystem where each portion of the platform complements the other."

- Matteo Del Fante, CEO -

Carbon Neutrality

Continuing the Group’s path towards carbon neutrality by 2030, we have set new targets to enhance long-term visibility. We will decarbonize the investment portfolio, with the target of Net Zero by 2050.

New commercial service model

The new service model will optimize retail customer coverage and transform the post office from a transactional to a relational space. Renewed focus on SME clients.

Omnichannel and Digital Transformation

The Group’s omnichannel strategy is aimed at creating an ecosystem and multi-channel platform model which, thanks to cutting-edge digital channels and simplified processes for serving its customers, aims to guarantee an excellent and homogeneous customer experience on all contact points.

The SuperApp

Incorporating the new payment wallet, the SuperApp will be fully customized to client’s individual profiles. Thanks to cutting-edge technology and Artificial Intelligence it will be a unique access point to Poste Italiane's ecosystem.

Polis Project

In order to further support Italy’s social and economic cohesion and reduce the digital divide, by 2026, about 7,000 post offices in small municipalities will be transformed into digital service hubs and access points for Public Administration services. Additionally, 250 co-working sites will be made available to citizens.

Logistic transformation

We will transform the postal network into an increasingly parcel focused one, develop a joint venture with a specialized logistic real-estate partner for the parcel business and new warehouses for contract logistics, leveraging technology to improve customer experience and operational efficiency.

In 2024, the first year of the Plan, we successfully achieved our strategic priorities: financial targets were met ahead of schedule and all key initiatives are well under way.

Main strategic highlights:

- New commercial service model

The new service model will optimize retail customer coverage and transform the post office from a transactional to a relational space. Renewed focus on SME clients

- Omnichannel and Digital transformation

The Group’s omnichannel strategy is aimed at creating an ecosystem and multi-channel platform model which, thanks to cutting-edge digital channels and simplified processes for serving its customers, aims to guarantee an excellent and homogeneous customer experience on all contact points.

- SuperApp

Incorporating the new payment wallet, the SuperApp will be fully customized to client’s individual profiles. Thanks to cutting-edge technology and Artificial Intelligence it will be a unique access point to Poste Italiane's ecosystem.

- Polis Project

In order to further support Italy’s social and economic cohesion and reduce the digital divide, by 2026, about 7,000 post offices in small municipalities will be transformed into digital service hubs and access points for Public Administration services. Additionally, 250 co-working sites will be made available to citizens.

- Carbon Neutrality

Continuing the Group’s path towards carbon neutrality by 2030, we have set new targets to enhance long-term visibility. We will decarbonize the investment portfolio, with the target of Net Zero by 2050.

- Logistic transformation

We will transform the postal network into an increasingly parcel focused one, develop a joint venture with a specialized logistic real-estate partner for the parcel business and new warehouses for contract logistics, leveraging technology to improve customer experience and operational efficiency.

2028 Group Financial Targets

|

€ bn

|

2023 | 2024 | 2025 | 2028 |

CAGR

23 - 28

|

| REVENUES | 11.99 | 12.59 | 12.8 | 13.5 | c.3%1 |

| EBIT2 | 2.62 | 2.96 | 3.2 | 3.2 | c.4% |

| NET PROFIT | 1.93 | 2.01 | 2.2 | 2.3 | c.4%3 |

1. 2023 numbers exclude sennder and Covid related mandate for a total of 0.2bn for the computation of the CAGR;

2. Excluding systemic charges related to insurance guarantee fund, on average c.80m per annum over the plan period;

3. 2023 numbers exclude sennder and one-off bonus for the computation of the CAGR

EBIT will grow to €3.2 billion in 2028 from our record operating profit of €2.62 billion in 2023 thanks to a solid revenue growth from all divisions, more than offsetting cost increase.

Net Profit will reach €2.3 billion in 2028, from €1.93 billion in 2023.

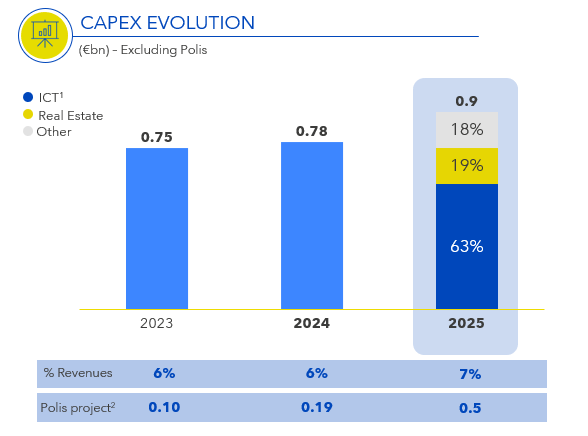

C. € 1.1 BILLION GROUP FUNDED CAPEX IN 2025

1. Information & Communication Technology related projects;

2. c.65% funded by the Italian government’s Complementary Fund of the National Recovery and Resilience Plan.

We have continued to increase our capital expenditure in key areas of development, to support business transformation.

In 2025 we expect €0.9 billion CAPEX with an acceleration of digital investments.

Around 70% of our Capex are related to initiatives supporting our ESG Strategic Pillars.

Dividend policy

| 2023 | 2024 | 2025 | 2026 | 2028 | |

|

DIVIDEND PER SHARE (€) |

0.80 |

1.08 |

|

≥1.0 |

|

| DIVIDEND PAYOUT | 54% | 70% | Increased from ≥65% to 70% | ||

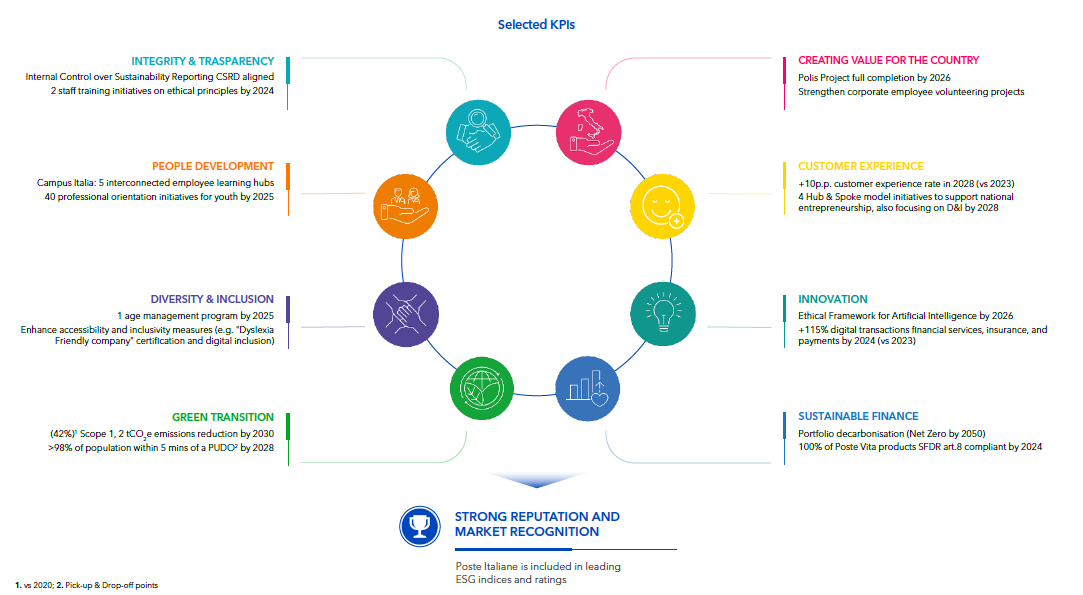

ESG targets

The table shows the breakdown of the pillars in the three areas (ESG): environmental, social and governance.

| Enviromental Information | Social Information | Governance Information |

|---|---|---|

| E1 - Climate change (Pillar: Green transition) |

S1 - Own workforce (Pillar: People development; Diversity and inclusion) |

G1 - Governance, risk management and internal control (Pillar: Integrity and Transparency; Creating value for the Country |

| E2 - Pollution (Pillar: Green transition) |

S2 - Workers in the value chain (Pillar: People development; Diversity and inclusion) | Entity specific (Pillar: Sustainable finance) |

| E3 - Resource use and circular economy (Pillar: Green transition) |

S3 - Affected communites (Pillar: Creating value for the Country) |

|

| S4 - Consumers and end users (Pillar: Customers experience; Innovation) |

On an environmental level, one of our most important commitments is the renewal of our fleet. By the end of 2024, we had 28,400 low-emission vehicles, both hybrids and electrics, i.e. 600 more vehicles than originally planned. To support the decarbonisation of logistics, in 2024 we developed the “Green Index”, an environmental footprint calculator that allows us to monitor the emissions produced for each parcel delivered.

Among other initiatives related to ESG targets, we continue to strive for the empowerment of our people and for Italy’s cohesion. We have adopted sustainable finance policies to integrate environmental and social issues into the group’s investment choices. We are promoting sustainability in our supply chain and we have introduced eco-friendly payment and SIM cards, as well as a rewards system to encourage good behaviour among our customers.

Our strategy by business area

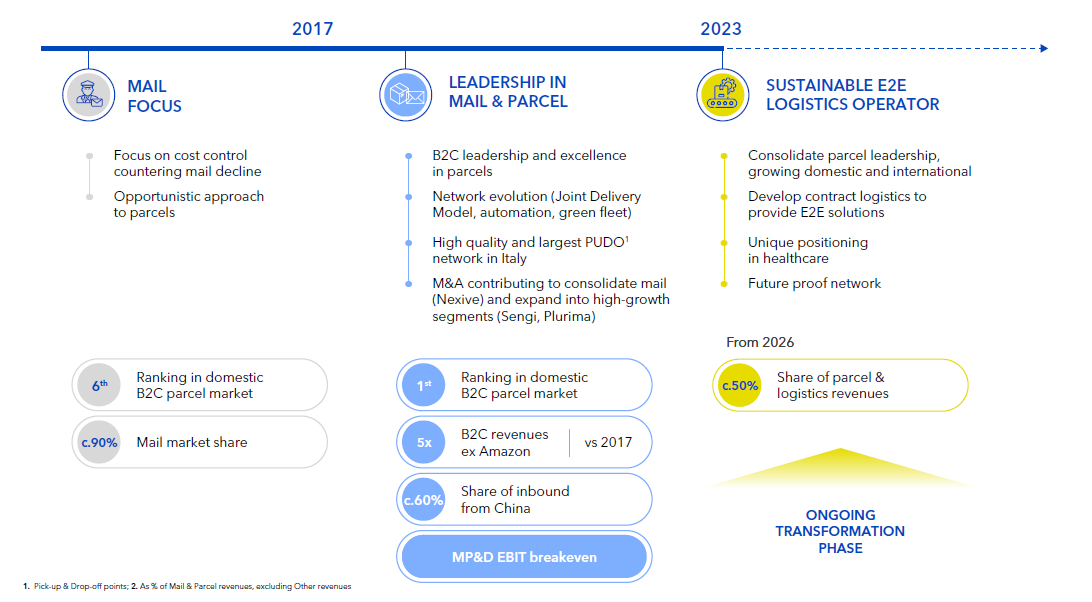

OUR TRANSFORMATION PATH

2028 Financial Objectives

| € bn | 2023 | 2024 | 2025 | 2028 | CAGR 24-28 |

| SEGMENT REVENUES | 3.75 | 3.84 | 4.0 | 3.90 | 0% |

| MAIL REVENUES | 2.07 | 2.12 | 2.1 | 1.60 | -7% |

| PARCEL & LOGISTICS REVENUES | 1.40 | 1.59 | 1.8 | 2.00 | 6% |

| EBIT | -0.04 | 0.10 | 0.1 | 0.101 | 0%. |

1 Excluding systemic charges related to insurance guarantee fund, currently estimated at c.20m on average per year over the plan period,

2028 Operational Objectives

- Expansion of warehouse capacity in Contract Logistics: we will almost double the capacity from 230,000 square metres in 2023 to 400,000 square metres in 2028, working towards warehouses that meet ESG standards.

- Delivery services: micro-fulfilment services will allow merchants delivery options within 4 hours. In 2025, we expect to increase the volume of parcels delivered by our employees to 42%, up from 39% in 2024, thanks to the launch of the new directly operated courier network in the first half of 2025.

- Expansion of the network of Pick-Up & Drop-Off (PUDO) points: the network will increase to about 40,000 units (from 28,000 in 2023 and about 30,000 in 2024), with an increasing number of lockers (2,000 by 2028) thanks to the joint venture with DHL.

- Increased accessibility of the PUDO network: the population coverage index for the PUDO network (i.e. accessibility within a radius of 2.5 km) will exceed 98% (from 95% in 2023), with 8 million kilometres saved.

- Sustainability of operations: waste materials in logistics centres are expected to be reduced by 40% by 2028.

- New business development: the plan aims to develop new business for €700 million in revenues, focusing on two areas (parcels and logistics), with growth supported by technology, sustainability and the real estate development strategy.

- Joint ventures in real estate: in order to accelerate and co-finance the Group’s infrastructure and real estate transformation process, in February 2025 we established the joint venture Patrimonio Italia Logistica - SICAF SpA, which we control 90% while Dea Capital Real Estate Sgr S.p.A. has a 10% share. The joint venture, under external management, improves operational efficiency and sustainability of the infrastructure.

We leverage favourable macroeconomic and market trends, including the closure of bank branches in small towns, by directing the financial needs of retail customers and small and medium-sized businesses to post offices. We also complement the traditional physical model with the opportunities provided by technological innovation.

The main strategic actions include:

- Strengthening Savings and Investment products by attracting new liquidity through digital channels and rebalancing customers’ investments to optimise their risk/return profile. In August 2024, we signed the new agreement with Cassa Depositi e Prestiti for the postal savings collection service for the three-year period 2024-2026.

- Expansion of Financing, improving approval rates and expanding partnerships, with particular emphasis on the salary-backed loans segment.

- Strengthening services for SMEs, with a comprehensive product range and more contact points, through the retail network and digital platforms.

2028 Financial Objectives

| € bn | 2023 | 2024 | 2025 | 2028 | CAGR 24-28 |

| GROSS REVENUES | 6.09 | 6.44 | 6.5 | 7.00 | 2% |

| EBIT1 | 0.86 | 0.90 | 0.90 | 0.90 | 0% |

| TFA | 581 | 590 | → | 624 | 1% |

1. Excluding systemic charges related to insurance guarantee fund, currently estimated at c.20m on average per year over the plan period.

2028 Operational Objectives

- Financial Assets Invested: the target is to reach €624 billion in 2028 (€581 billion in 2023 and €590 billion in 2024).

- Financing: the 2028 target is €4.3 billion compared to €3.3 billion in 2023 and €3.6 billion in 2024. Personal loan volumes will increase to 3.4 billion thanks to greater customer engagement, including through a revamped digital experience and an improved approval rate from the banking partner network. Volumes for salary- or pension-backed loans will reach €0.9 billion (€0.7 billion in 2023).

- SMEs: the number of current accounts will reach 400,000 (278,000 in 2023 and 300,000 in 2024), with an average balance per account of €11,000, up from €8,400 in 2023 thanks to a renewed commercial focus, with a state-of-the-art service platform and a new service model. In particular, there will be 400 new “Punto Poste Business Counters” in the main post offices, with dedicated consultants.

- Revenues from the investment portfolio: these will amount to €2.5 billion at the end of the plan (€2.4 billion in 2023 and €2.6 billion in 2024), thanks to effective management that will generate higher revenues. Proactive portfolio management will be aimed at stabilising medium- to long-term returns, providing flexibility to adapt to different market conditions.

For the Protection sector – which includes all Non-Life and Life Protection insurance products – we confirm our ambition to reduce the country’s underinsurance by making insurance protection more accessible through the development of the offer and an integrated advisory model. We will increase the channels of access to the insurance offer, including through the enhancement of the Net Insurance Group, acquired in February 2025.

We are leveraging the growing demand for personal insurance products, fuelled by the progressively ageing population, changes in lifestyle patterns and reduced market penetration in Italy compared to other developed markets.

2028 Financial Objectives

| € bn | 2023 | 2024 | 2025 | 2028 | CAGR 24-28 |

| SEGMENT REVENUES | 1.60 | 1.60 | 1.7 | 1.90 | 4% |

|

LIFE INVESTMENTS & PENSION

|

1.40 | 1.40 | 1.5 | 1.60 | 3% |

|

PROTECTION

|

0.20 | 0.20 | 0.2 | 0.30 | 11% |

| EBIT1 | 1.40 | 1.40 | 1.5 | 1.60 | 3% |

| NET INCOME | 1.00 | 0.90 | 1.0 | 1.10 | 5% |

1 Excluding systemic charges related to the new insurance guarantee fund currently estimated at c.60m on average per year over the plan period.

- Technical Investment Reserves: we expect to reach more than €180 billion at the end of the plan (157 billion in 2023).

- Share of insurance investment products compliant with art. 8 of the Sustainable Finance Disclosure Regulation (SFDR): 100% by the end of 2024.

- Protection Premiums: our goal is to reach no less than €1.5 billion (€0.8 billion in 2023), thanks to the increase in demand and the low penetration of protection products in the Italian market.

- Solvency II Ratio: during the period of the plan, the ratio will decline from 307% in 2023 to just above 200%, providing a substantial buffer to cushion any market volatility.

Postepay services now represent an open payments ecosystem centred on digital payments to which home and family services, such as fibre and energy, have been added, leveraging Poste Italiane's omnichannel platform. The Postepay ecosystem has considerable growth potential based on the structural low penetration of digital payments in Italy compared to European standards and a unique market positioning in the sector.

The transaction value will grow faster than the market due to the strong presence in the e-commerce sector.

To grow, we will leverage our large and loyal customer base and, in particular, our 10.5 million IBAN Postepay Evolution cards.

In telecommunication services, Postepay is ready to exploit the opportunities emerging from the expansion of demand for fibre connections across the country and to strengthen its position in the mobile sector through the extension of the Postepay Connect model. The recent acquisition of TIM constitutes a strategic investment for our Group, with the aim of creating synergies between the companies and facilitating the consolidation of the telecommunications market in Italy.

Finally, in the energy sector, which was successfully launched in 2023, Postepay will exploit an innovative and transparent offer, with a non-aggressive sales method.

2028 Financial Objectives

|

€bn

|

2023 | 2024 | 2025 | 2028 | CAGR 24-28 |

| SEGMENT REVENUES1 | 1.45 | 1.60 | 1.7 | 2.20 | 8% |

| EBIT | 0.44 | 0.50 | 0.6 | 0.70 | 9% |

| NET PROFIT | 0.34 | 0.40 | 0.4 | 0.50 | 6% |

1 Revenues are restated net of commodity price and pass-through charges of the energy business.

2028 Operational Objectives

- New contracts: our goal is to have 15 million new contracts by the end of the plan – including for cards, mobile phones, fixed and fibre connections, energy and gas – thanks to the unique sales proposal that integrates payments, telephony and energy.

- Wallets: there will be 16 million digital payment wallets by the end of the plan, compared with 12 million in 2023.

- Transactions: total value will exceed €130 billion at the end of the plan (€80.3 billion in 2023), with a boost coming from e-commerce, which will reach €42 billion (€24.3 billion in 2023).

- Number of transactions: will rise to 4.6 billion (2.7 billion in 2023), with the number of e-commerce transactions at 1.1 billion (0.6 billion in 2023).

- Telephone lines (mobile, fixed and fibre): the target at the end of the plan is to have 5.5 million (4.7 million in 2023).

- Energy offer: the number of contracts will reach 2.5 million (350,000 in 2023).

Postepay intends to contribute to the green transition of the Group and the country, with mechanisms that reward the most eco-conscious customers.

Targets & achievements

We have a consolidated track record of exceeding our financial targets.

| € bn unless otherwise stated | 2017 | 2018 | 2019 | 20204 | 2021 | 20221 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|

| Revenues 2 |

|

|

10.96

|

10.53

|

11.22

|

|

|

|

12.8

|

| Ebit |

1.12

|

|

|

1.52

|

|

|

|

|

3.2

|

| Net profit 3 |

0.69

|

|

|

|

|

|

|

|

2.2

|

| DPS (€) |

0.42

|

0.44

|

0.46

|

0.49

|

|

|

|

|

-

|

| Achieved |

|

1 2022 numbers are restated for IFRS17;

2 Revenues exclude commodity price and pass-through charges related to the energy business. 2017-19 revenues are restated net of interest expenses and capital losses on investment portfolio;

3 0.76bn excluding write-off of 0.07bn for 2017, 1.01bn excluding positive tax one-offs of 0.39bn for 2018; 1.23bn excluding SIA stake revaluation and positive tax one-offs of 0.11bn for 2019, 1.11bn excluding positive tax one-offs of 0.1bn for 2020; 1.33bn excluding Nexi stake revaluation and positive tax one-offs of 0.25bn for 2021

4 Impacted by Covid-19

We have demonstrated our nature of being an antifragile company: we have always adapted to a rapidly evolving operating context, transforming challenges into opportunities.

2024 has been a record year. We achieved record-breaking revenues of €12.6 billion, record adjusted EBIT at €2.96 billion, almost three times the 2017 level and net profit at €2 billion, two years ahead of plan and fully aligned with our updated guidance. All our four business units delivered solid revenue growth, further validating the strength of our highly diversified platform business model.

Growth trajectory confirmed for 2025, guidance of €3.1 billion adjusted Ebit and €2.1 billion net income.