Group dividend policy

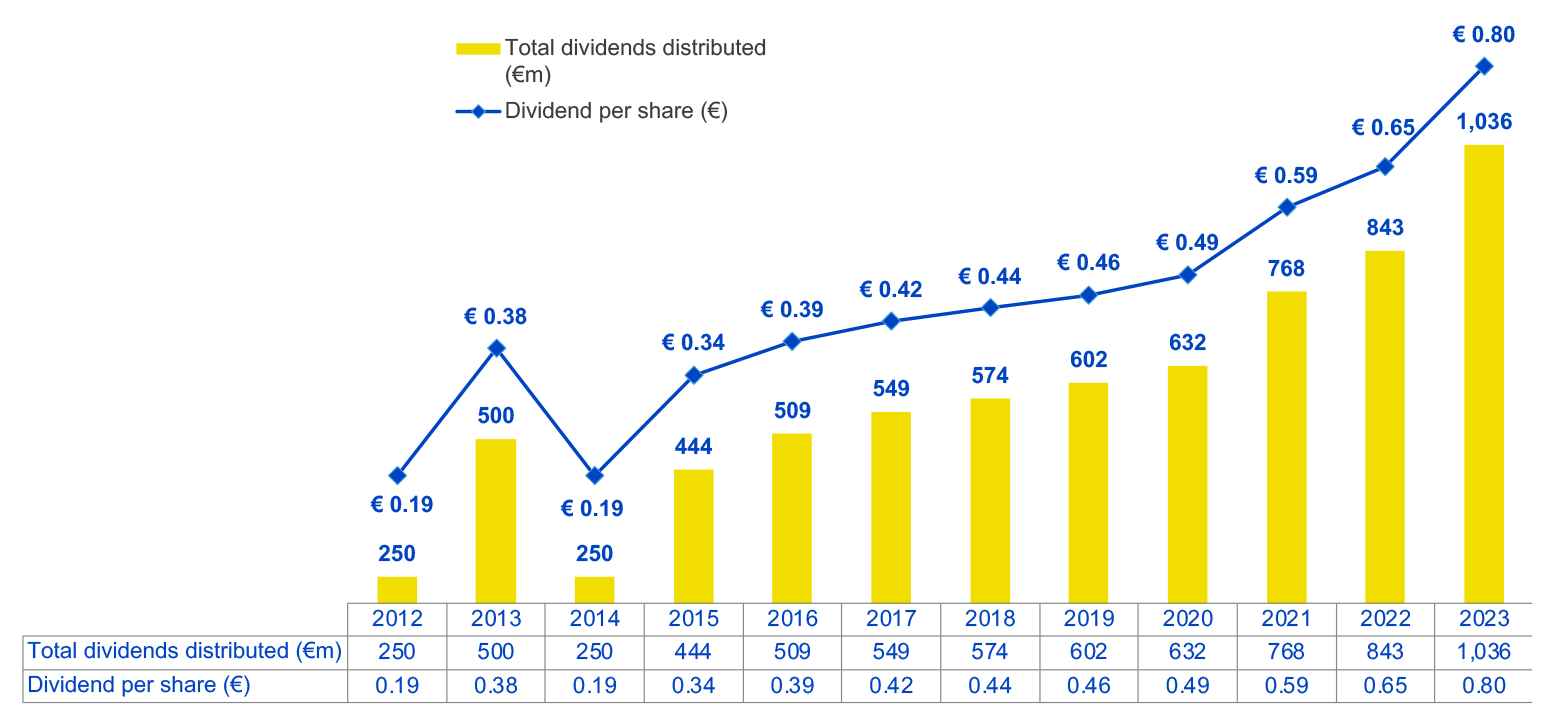

Our objective is to guarantee a competitive return to shareholders. Enhanced sustainable cash and capital generation driving an ample and diversified dividend upstream from subsidiaries supporting an improved Group dividend policy: from a proposed €0.80 DPS in 2023 to not less than €1.0 DPS from 2026 onwards, increasing from 2023 by 7% per annum with at least 65% pay-out ratio over the plan. Poste Vita remittance ratio up to 100% from 2024, providing additional flexibility. Over 1.5x dividend coverage ratio through the plan horizon, providing additional financial flexibility.

On 2023 results we proposed a dividend per share of 80 cents compared to the original figure of 71 cents, an increase of 23% year-on-year.

This upgrade is not only driven by a consistent financial performance delivered over time but also by an increased visibility on the cash flow generation across all businesses.

On 2023 results we proposed a dividend per share of 80 cents compared to the original figure of 71 cents, an increase of 23% year-on-year.

This upgrade is not only driven by a consistent financial performance delivered over time but also by an increased visibility on the cash flow generation across all businesses.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total dividends distributed (€m) | 250 | 500 | 250 | 444 | 509 | 549 | 574 | 602 | 632 | 768 | 843 | 1,036 |

| Dividend per share (€) | 0.19 | 0.38 | 0.19 | 0.34 | 0.39 | 0.42 | 0.44 | 0.46 | 0.49 | 0.59 | 0.65 | 0.80 |