BancoPosta is one of Italy’s biggest financial service providers, a major player that is constantly expanding its range of services for households. It is mainly engaged in:

- asset management products (units of open-ended mutual funds established by BancoPosta Fondi SGR)

- asset administration products

- Poste Vita and Poste Assicura insurance policies

- third-party financing products and credit cards.

As concerns asset management, BancoPosta Fondi SGR manages open-ended mutual investment funds, delivering significant returns over the years. It is also specialised in the management of Eurozone sovereign bonds and corporate bonds. Asset management is a business we are targeting to drive our future growth, with a view to offering simple, clear and well-structured products, building on the relationship of trust we have with our customers.

Financial markets

Overall, 2022 was a particularly difficult year for both equity and bond investors. The capital markets reflected this scenario in their stock prices, with bond and share prices falling simultaneously, an event that has occurred only once in the last 50 years (1994); global stock markets have lost 19.4% since the beginning of the year1, while bond markets have fallen by 13.7%2. Stock market performance was driven by a decline in market3 multiples while earnings estimates remained relatively stable in both the EU and the US, helped in part by the energy sector and the ability of some companies to pass on to their customers the increased production costs resulting from higher commodity prices. In 2022, the S&P 500 and Nikkei 225 indexes4 lost roughly 20% and 9%, respectively, while the EuroStoxx 50 lost around 12%.

The cycle of central bank rate hikes has led to a significant repricing of the European bond segment: the yield on the 10-year multi-year Treasury bond (BTP), which stood at around 1.2% at the start of the year, has progressively increased, reaching 4.8% in October, the highest level of the year. At the same time, the BTP-BUND spread also rose, reaching 250 basis points in October. From mid-October to mid-December, yields on long-term government bonds in the major advanced economies (in particular, the US, Europe, the UK) fell significantly, returning to values close to the yields recorded in the first half of 2022. Contributing to this development was the easing of the central banks’ monetary policy tightening process, which changed traders’ expectations regarding the pace and duration of the monetary tightening process. Expectations of a more decisive tightening of monetary policies spread following the December meetings of the central banks of the major advanced economies and the 10-year BTP ended 2022 with a yield of 4.7% and the BTP-Bund spread in the 210 basis point area.

In the Italian stock market, the FTSE MIB & declined by 13% year-on-year in 20225.

Corporate bonds, against this backdrop of uncertainty and rising yields, rose for much of the year, particularly on the more speculative component. Towards the end of the year, however, credit spreads partially retraced, helped by a generalised reduction in volatility and a return of interest for the asset class by investors, given the levels reached by spreads in the autumn.

- the active management of the banking book, consisting of public and private customer deposits and relative lending activities;

- promotion and management of the postal savings instruments issued by Cassa Depositi e Prestiti (bonds and savings books);

- transaction banking services (payments and collections), such as postal payment slips, F24 tax forms, national and international postal money orders, Moneygram and Eurogiro services;

- promotion and distribution, through its own distribution platform, of financial products issued by third parties or other group companies, such as:

- asset management products (units of open-ended mutual funds established by BancoPosta Fondi SGR)

- asset administration products

- Poste Vita and Poste Assicura insurance policies

- third-party financing products and credit cards.

As concerns asset management, BancoPosta Fondi SGR manages open-ended mutual investment funds, delivering significant returns over the years. It is also specialised in the management of Eurozone sovereign bonds and corporate bonds. Asset management is a business we are targeting to drive our future growth, with a view to offering simple, clear and well-structured products, building on the relationship of trust we have with our customers.

Financial markets

Overall, 2022 was a particularly difficult year for both equity and bond investors. The capital markets reflected this scenario in their stock prices, with bond and share prices falling simultaneously, an event that has occurred only once in the last 50 years (1994); global stock markets have lost 19.4% since the beginning of the year1, while bond markets have fallen by 13.7%2. Stock market performance was driven by a decline in market3 multiples while earnings estimates remained relatively stable in both the EU and the US, helped in part by the energy sector and the ability of some companies to pass on to their customers the increased production costs resulting from higher commodity prices. In 2022, the S&P 500 and Nikkei 225 indexes4 lost roughly 20% and 9%, respectively, while the EuroStoxx 50 lost around 12%.

The cycle of central bank rate hikes has led to a significant repricing of the European bond segment: the yield on the 10-year multi-year Treasury bond (BTP), which stood at around 1.2% at the start of the year, has progressively increased, reaching 4.8% in October, the highest level of the year. At the same time, the BTP-BUND spread also rose, reaching 250 basis points in October. From mid-October to mid-December, yields on long-term government bonds in the major advanced economies (in particular, the US, Europe, the UK) fell significantly, returning to values close to the yields recorded in the first half of 2022. Contributing to this development was the easing of the central banks’ monetary policy tightening process, which changed traders’ expectations regarding the pace and duration of the monetary tightening process. Expectations of a more decisive tightening of monetary policies spread following the December meetings of the central banks of the major advanced economies and the 10-year BTP ended 2022 with a yield of 4.7% and the BTP-Bund spread in the 210 basis point area.

In the Italian stock market, the FTSE MIB & declined by 13% year-on-year in 20225.

Corporate bonds, against this backdrop of uncertainty and rising yields, rose for much of the year, particularly on the more speculative component. Towards the end of the year, however, credit spreads partially retraced, helped by a generalised reduction in volatility and a return of interest for the asset class by investors, given the levels reached by spreads in the autumn.

1. MCSI World index.

2. FTSE World Government Fixed income Index.

3. Market multiples are ratios between the market prices (quotations) of an equity instrument and a given financial statement size. The most commonly used financial statement quantities are profits, carrying amount of equity, sales. Source: Glossary of the Italian Stock Exchange.

4. Source: Bloomberg.

5. Source: Bloomberg.

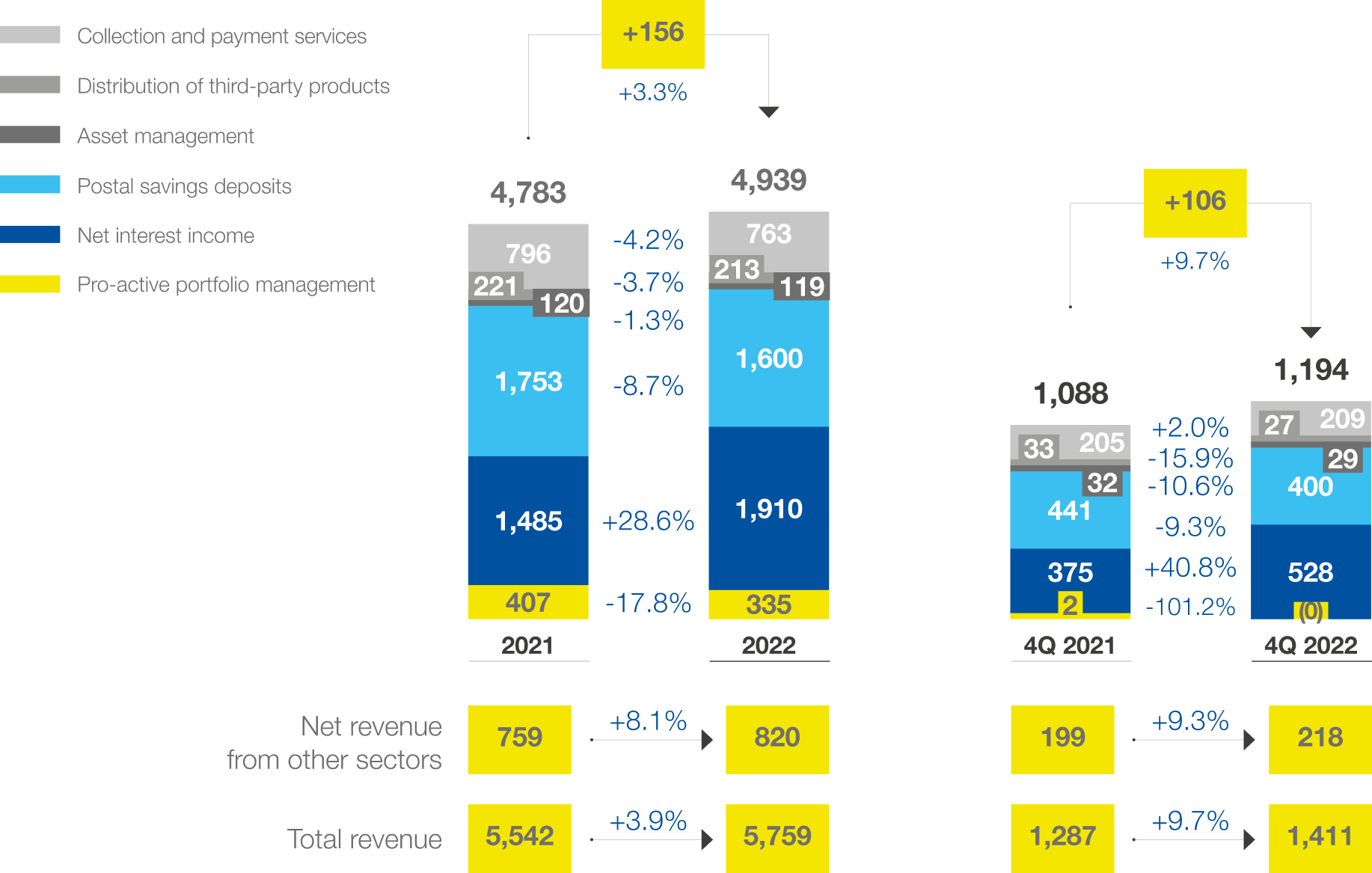

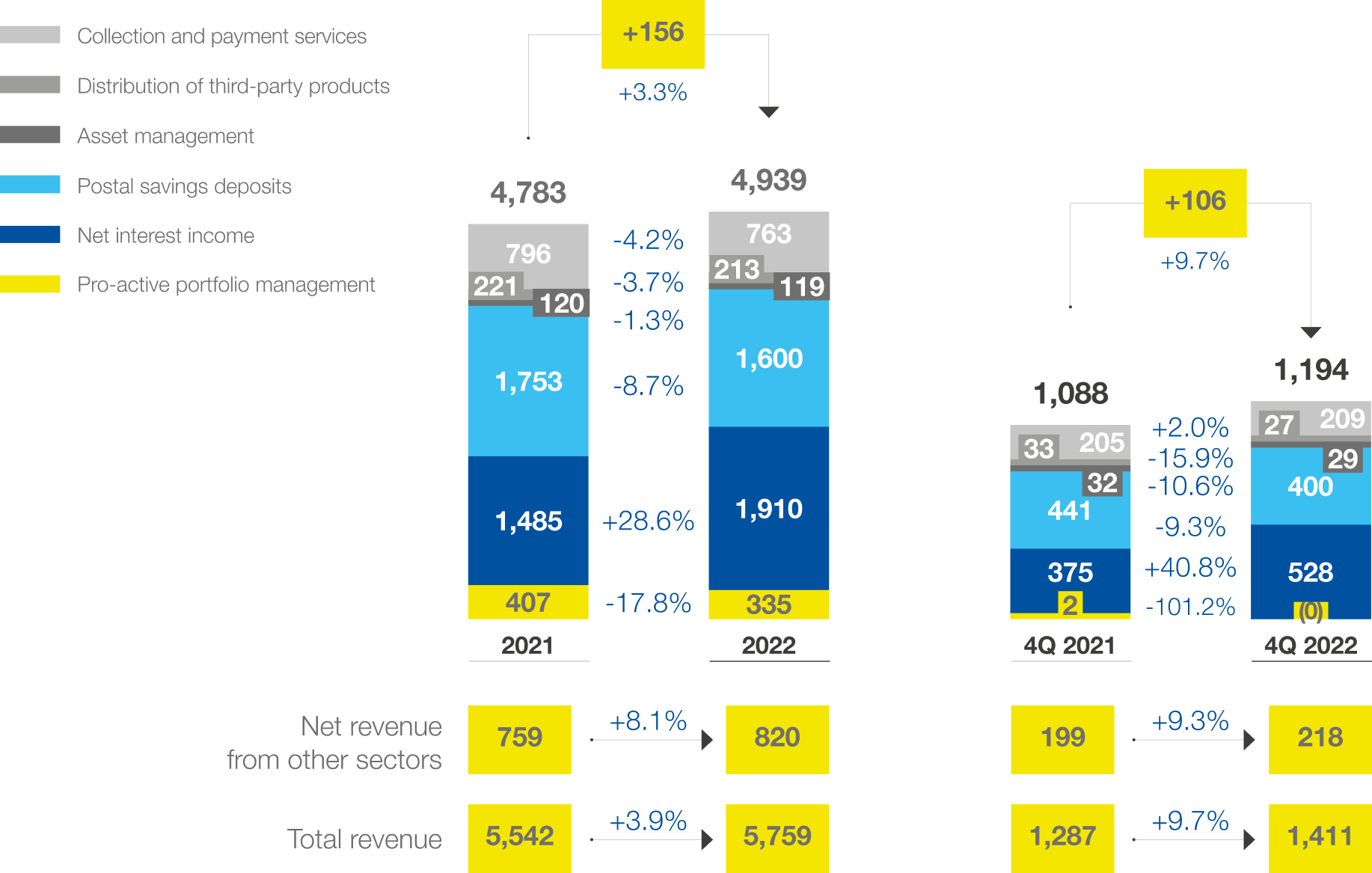

| FY 2022 External Revenues and Revenues from other sectors (€m) | 4,939 |

|---|---|

| Collection and payment services | 763 |

| Distribution of third-party products | 213 |

| Asset management | 119 |

| Postal savings deposits | 1,600 |

| Net interest income | 1,910 |

| Net capital gains | 335 |

EXTERNAL REVENUE AND REVENUE FROM OTHER SECTOR

(€m)

CURRENT ACCOUNT DEPOSIT

(€bn)

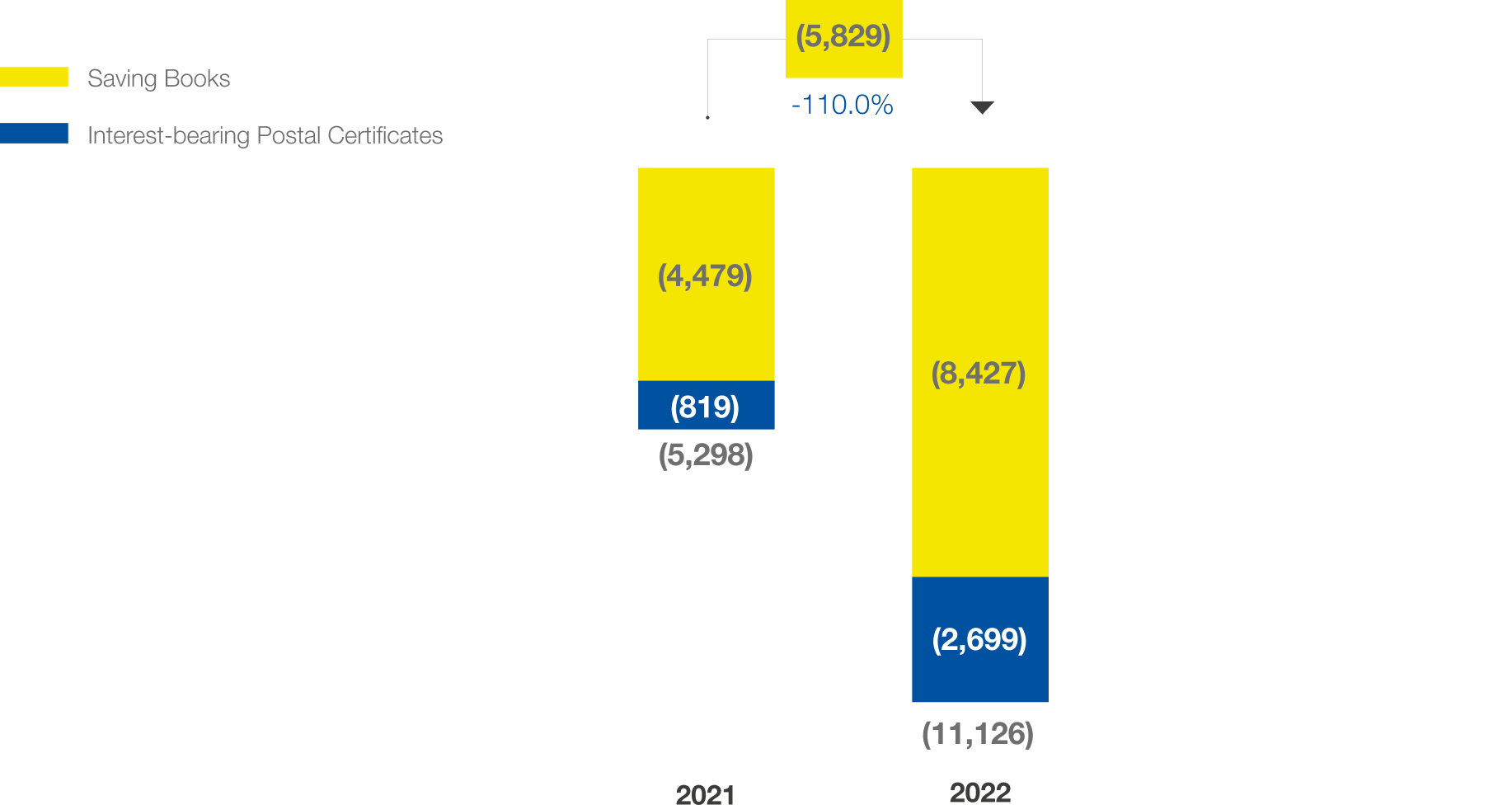

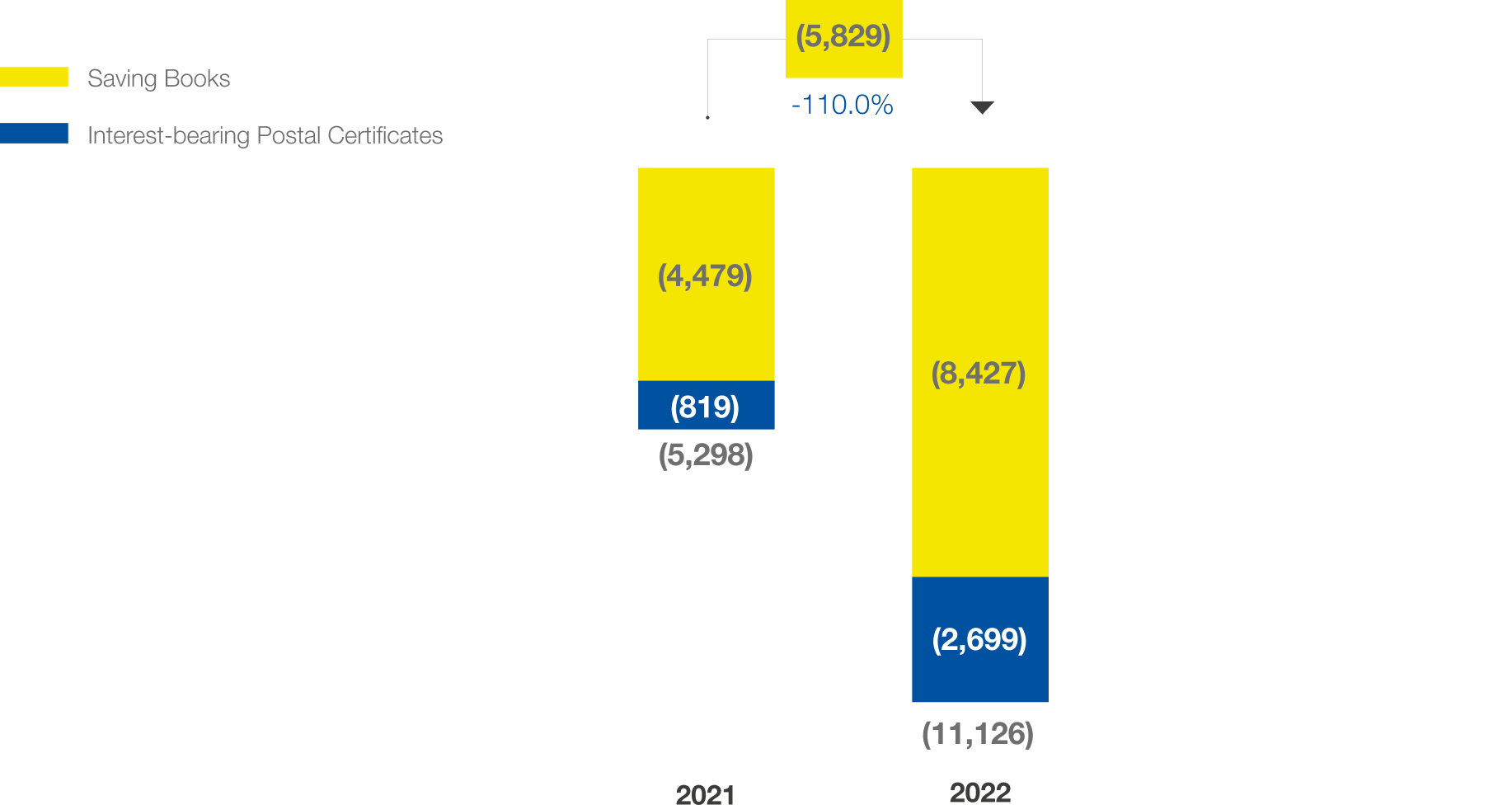

POSTAL SAVINGS NET INFLOWS

(€m)

Data source: Annual Report 2022